IAPETUS White Paper 1(1-20)Aug2017

ABSTRACT

Quantitative trading is becoming increasingly more popular as we search for new insights with

better tools. Iapetus Consulting LLC. is a startup company with a profoundly original behavioral

psychology research idea asking the question: Does news impact the volatility in markets and if

so, can this be quantified, analyzed, and used real time by investors? The Iapetus real time

inventing tool times the market using complex algorithms that trawls news articles and quantifies

news media sentiments throughout the day as news cycles change. Our unique training data

going back to September 2016 is used to forecast changes in the stock market with

Buy/Hold/Sell recommendations. Using only nine different news sources with an array of

different ideologies we have been fortunate to find good signal correlating to market movement.

Our algorithm scans thousands of articles every day. It searches our unique library of sentiment

trigger words which are weighted per our unique scaling design. This makes up the aggregate

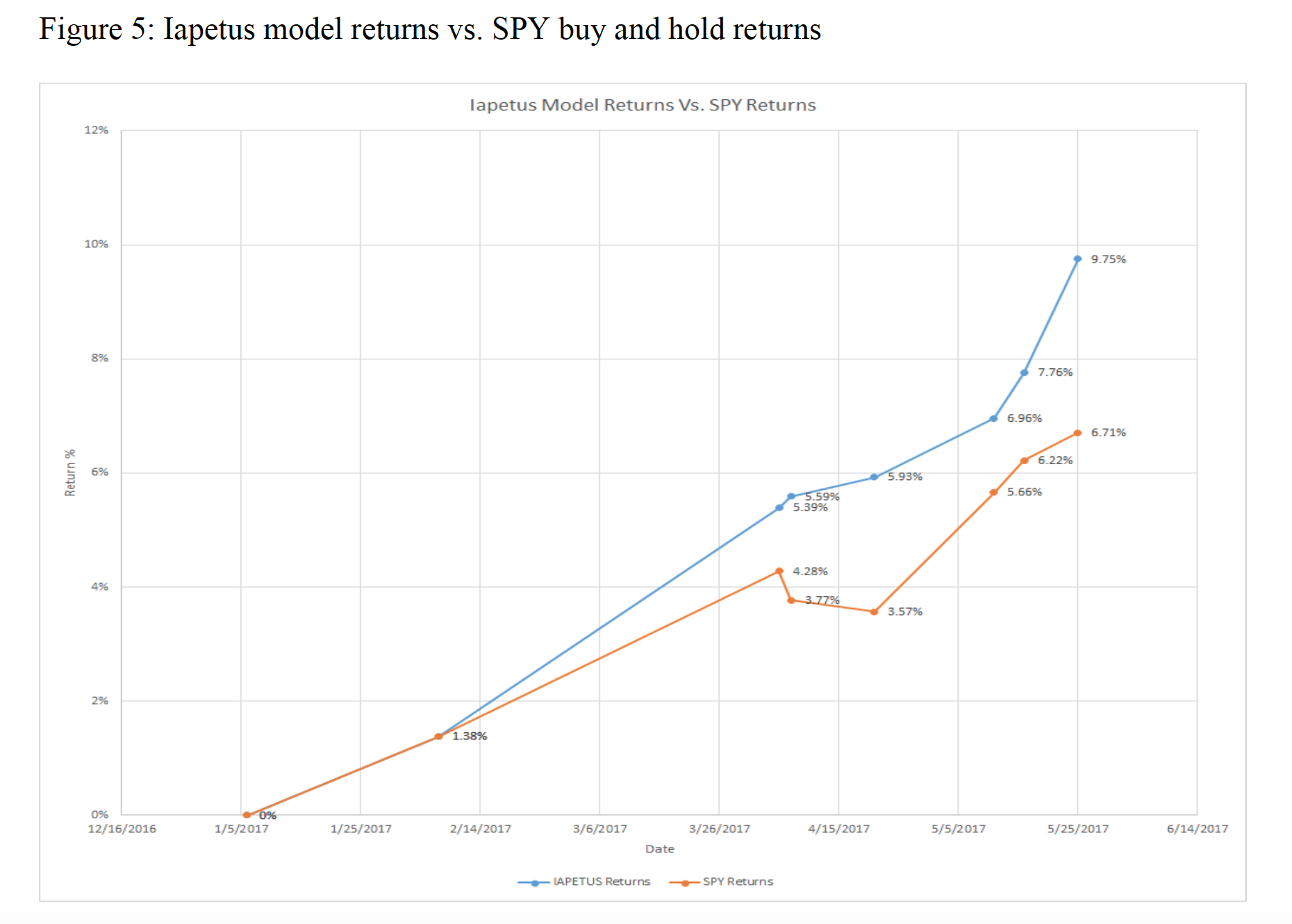

sentiment quantification of each news source. The goal of Iapetus is to create an investing model

that will consistently outperform the stock market. In this paper, we discuss our methodology

and design of simulation models that buy and sell funds based on the Iapetus algorithm.